Written by: Sumeet Singh | Chief Executive Officer

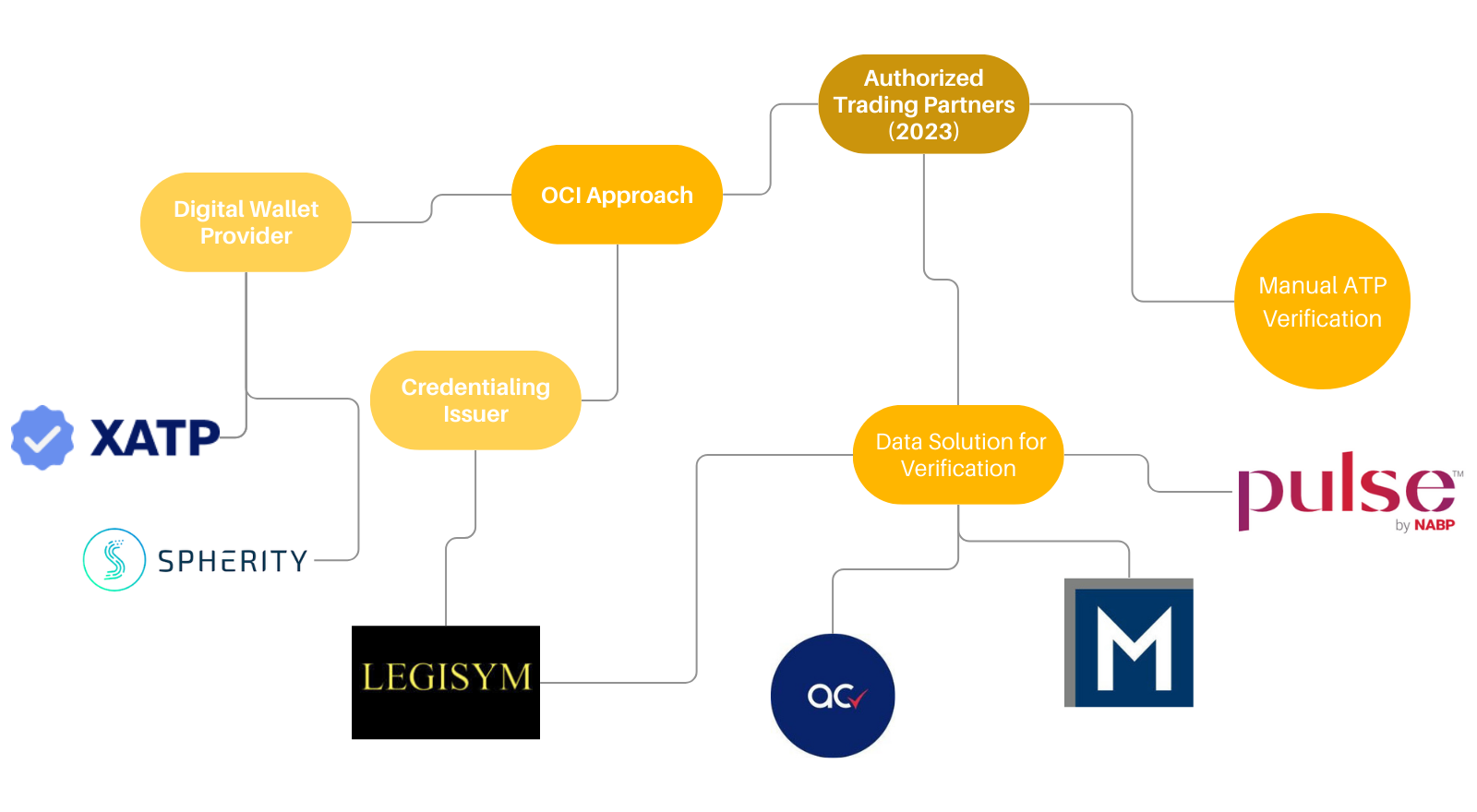

The Drug Supply Chain Security Act (DSCSA), a cornerstone in pharmaceutical compliance, has stimulated a thriving market for specialized compliance solutions. Established and new software providers are vying to deliver various types of solutions including Serialization, Data Aggregation, and VRS solutions in this evolving landscape. Our DSCSA ATP Solution Map provides an overview of the competitive landscape.

However, one piece of the DSCSA puzzle, Authorized Trading Partner (ATP), has been relatively calm as the “status quo,” where providers focus on aggregating and providing licensing data gathered from regulatory agencies, seemed to fully satisfy the ATP requirement. However, that is now heating up as a new approach, under the Open Credentialing Initiative, and a new provider of data, the NABP, have begun jockeying for position – and wallets.

This article examines the dynamic DSCSA ‘ATP’ solution provider sector and the transformative power of emerging players and the forthcoming opportunities and challenges in the field. Our goal is to offer insights that enable stakeholders to better navigate this rapidly changing market.

Existing Provider

Existing solution providers, such as MedPro Systems and License Verify, offer a robust solution for industry where millions of data points on federal and state licensing and registration for dispensers, healthcare practitioners, healthcare organizations and more is rigorously maintained and sold to industry. These data points already integrate with drug manufacturer and distributor workflows so that subscribers can have insight into whether to ship an order to their customers.

As business requirements for solutions get reimagined due to the DSCSA, there are holes that new competitors are attempting to fill.

Credentialing

The Open Credentialing Initiative (OCI) is a collaborative effort aimed at establishing standardized protocols for decentralized identity and verifiable credentials in the life sciences industry. By championing interoperability and security, OCI hopes to revolutionize the way credentialing data is managed and shared.

Two main providers have developed solutions as a part of OCI: Spherity and XATP. Investing heavily into marketing, product development, and a key contributor to HDA, these providers are leading the pack within the credentialing push.

Credentialing service providers face substantial challenges as they seek to integrate their solutions into the highly regulated and complex world of the pharmacy space. A primary challenge lies in instigating behavior and workflow changes. To ensure the success of their credentialing services, these providers must persuasively demonstrate that their approach is not only simpler and more cost-effective than existing workflows, but also worth the disruption of transitioning to a new system. Convincing stakeholders to modify their entrenched routines can be a formidable task.

An equally significant challenge, if not more so, is driving widespread adoption of their credentialing services. To attain success, these providers must “cross the chasm” – a concept popularized by Geoffrey Moore’s influential work “Crossing the Chasm” – which involves transitioning from early adopters to the early majority. This leap is crucial for instigating a powerful network effect where trading partners begin to incentivize each other to utilize credentialing services. Achieving this momentum can catalyze the acceptance and use of credentialing across the industry. But perhaps, no greater challenge exists than NABP Pulse that is touting a “flexible approach” that they insinuate will better meet industry needs.

NABP Pulse

An industry and regulatory powerhouse, the NABP, has introduced Pulse – challenging both ‘status quo’ providers, and fledging Credentialing providers.

NABP is well-positioned for strategic advantage in adoption due to several factors. Firstly, they can leverage the anticipated future uptake of the Product Tracing module, a resource that no other provider currently has, fortified by regulator endorsement. Secondly, NABP’s established lobbying prowess could be a potent force to push for mandated adoption, a strategy previously successful with various Accreditation and Inspection programs. Finally, their pre-existing presence within the space offers a considerable edge: NABP is brand name already known to pharmacists and pharmacies and are therefore well-situated to integrate new solutions into familiar environments.

More robust data is another potential advantage for NABP as they have established relationships with various Boards of Pharmacy and other regulatory agencies. While no formal analysis exists, it seems likely that these Boards would be more inclined to collaborate with a known entity like NABP. Furthermore, NABP’s existing engagement with pharmacists and pharmacies offers another crucial benefit. Virtually all pharmacists and pharmacies have an NABP eProfile, a consequence of their requisite examinations conducted through NABP. This effectively provides NABP with an uniquely comprehensive database in the pharmacy space, underpinning their capacity to facilitate and expedite the adoption of new systems or solutions.

On the other hand, there are several concerns surrounding Pulse. This includes business concerns, such as Pulse being NABP’s first commercial software solution and industry’s concern on NABP’s proclivity toward reporting potentially non-compliant activities to regulators. As well, we would like to see NABP provide clarity on any ethical concerns, such as how NABP-affiliated Board members are supposed to handle disciplinary actions that stem from Pulse, and NABP’s ability to undercut pricing by leveraging their tax-exempt status.

Conclusion

As we navigate the intricate terrain of DSCSA compliance solutions, the emergence of new players and strategies in the ATP solution provider sector is stirring a significant shift in the marketplace. Amid these shifting dynamics, the success of providers—both old and new—will hinge on their ability to adapt, innovate, and deliver value in an ever-evolving landscape. Our mission remains to illuminate these developments and deliver insights to help stakeholders successfully navigate this swiftly changing market.